Hello there!

Prior to my finance days here, I happened to pursue mechanical engineering. I bring this up because researching the company covered in this post brought back some (not so) sweet memories. I distinctly remember a certain subject that gave me, and most others, a rather tough time - Design of Transmission Systems. The subject required us to design systems for the transmission of mechanical power using gear drives, belt drives, and chain drives. You get the gist. Or maybe you don’t. It’s alright if you don’t, I didn’t either. I still managed a B+.

Putting my mech woes aside, our company of interest is in the business of manufacturing belts, used in transmitting power via belt drives. Belt drives have myriad applications, as we’ll see. So with a tribute to my dreaded subject, let’s dive straight into it! Into the company, not the subject…

Market Cap: ₹1108 Cr

CMP: ₹ 813

Sector: Rubber

Industry: Belts

Business Snapshot

PIX Transmissions Limited (PIX) is a manufacturer of belts and related mechanical power transmission products.

Belts are used for power transmission in machinery for Industrial, Agricultural, Automotive, and Lawn & Garden applications.

Founded in 1981 by Amarpal Sethi, the Sethi family owns a 61.78% stake in the company.

PIX has 4 manufacturing units located in Nagpur, with a capacity of 270 lakh belts per annum. The facilities are top-notch, with extensive automation. The company website is worth exploring and has a video of its plants, a must-watch according to me. It is endearing to see a relatively small company set up such advanced plants.

The company also exports to over 100 countries, with revenues split roughly 50-50 between domestic and exports. PIX has subsidiaries in the UK, Germany, and UAE that aid in distribution and also provide technical and logistical support.

The global market size is US$ 3.5 billion and is expected to reach US$ 4.4 billion by 2027, growing at a CAGR (Compound Annual Growth Rate) of 4.1%

PIX’s business can broadly be divided into 3 segments:

Industrial Belts

In any industry, belts are a critical component of the machinery. In case of belt failure, the cost of downtime far outweighs the cost of the belt. Therefore, belts are replaced periodically as part of preventive maintenance. In fact, the replacement market comprises 50% of the demand for belts. PIX mainly operates in the replacement segment.

Agricultural Belts

PIX is a market leader in the agricultural belts segment. Agriculture in India is largely dependent on labor. However, this has been changing. With increasing mechanization in agriculture in the upcoming years, PIX has a good runway for growth.

Automotive Belts

The automotive segment is a low-margin, high-volume business. Profits are generated when economies of scale kick in. Essentially how this works is – An auto OEM, say Toyota, will chalk out their requirement. The belt supplier will set up a production line dedicated to manufacturing these customized belts for Toyota. This segment is dominated by large MNCs such as Gates Corp. PIX consciously stays away from this business but generates some revenue to maintain its presence.

Competitive Advantage

Since belts are a cheap yet critical component, the focus is on quality. PIX produces belts of the highest quality, in line with international standards, which is apparent from the fact that they are approved suppliers in developed markets like Europe and North America.

PIX can manufacture belts from 10” to 10,000” in diameter offering over 32,000 SKUs (stock-keeping units). The key to developing such a wide range of products is tooling. Each SKU requires a unique tool. If a competitor wishes to replicate PIX’s product offering, developing the tools would take two decades. Money is not the problem, time is.

Additionally, getting a belt approved in a company is a lengthy process. The belt supplier provides a belt for one machine. The user tests the belt by running the machine for several months, usually well past the scheduled replacement, to check for performance and durability. If the pilot test goes well, the belt is installed in additional machines. The entire process takes 18-24 months. Operating for over 40 years, PIX has forged strong relationships with customers.

Consider that you are the procurement head for an industrial plant. Your plant is using PIX’s belts and operations are smooth, there have been no belt failures so far. A new belt supplier approaches you, offering a better price. Will you take the risk of switching? No. The cost saving is insignificant compared to the magnitude of risk. Not to mention, you will probably lose your job if the new belt fails. Subconsciously we all follow the adage:

Don’t fix what isn’t broken.

Collectively, these provide PIX with a unique economic moat.

Financials

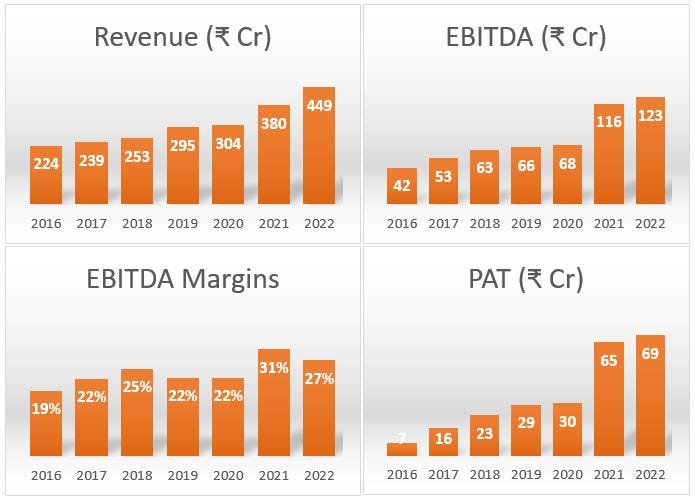

PIX reported revenues of ₹ 449 Cr in FY22, up 18% YoY. EBITDA and PAT growth were marginal at 6% YoY.

Margins took a hit in FY22 owing to the increased cost of raw materials due to inflation. This is evident when we view the cost of raw materials as a percentage of expenses incurred:

It seems counterintuitive that PIX has shown growth in revenue with a corresponding fall in employee cost as a proportion of expenses. This is attributable to the automation of plants carried out by the company which has enabled it to grow while simultaneously employing lesser people.

PIX has a debt-to-equity ratio of 0.32

ROCE is at 28.3% and ROE is 20.7%

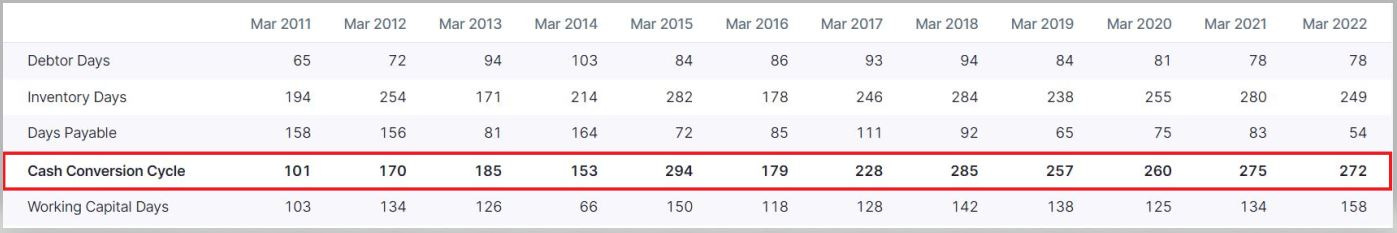

The nature of the business is such that inventory days are very high at 249. This is also due to the large number of SKUs offered by PIX.

Investment Thesis

The Indian CapEx cycle will increase demand for belts in industries.

Growing mechanization in Indian agriculture will boost demand for PIX belts.

PIX products are high quality and the company is gaining market share in foreign developed markets, where margins are more attractive.

The company is undergoing capacity expansion from 180 to 270 lakh belts per annum, which is likely to go live in H2FY23.

PIX has strong financials, with an experienced management. Corporate governance standards have also been good.

Investment Risks

Raw materials are imported; this exposes PIX to foreign exchange risk. However, since PIX derives 50% of revenues from exports, they have a natural hedge against this risk.

The business is capital intensive, fast growth cannot be achieved from internal accruals. If PIX aims for high growth, it would have to take on debt for funding capex.

Technology obsolescence – Some industries (textiles, for instance) are upgrading to modern machines which work on a cup-link mechanism, doing away with the need for rubber V-belts.

The cash conversion cycle is abysmal. Inventory days paint just as sorry a picture. To put things into perspective, at the end of FY22 PIX had 125 Cr stuck in inventory, which is a quarter’s worth of sales! The high inventory is due to the large number of SKUs that PIX has to keep in stock as customers expect prompt delivery. While we understand that high inventory is a characteristic of this business, it is a risk worth keeping in mind.

Valuations

Pix is trading at a PE of 16 compared to a sector PE of 25.

In an optimistic scenario, PIX will have sales of 600 Cr this FY23. Assuming an EBITDA margin of 26%, we can expect a PAT in the vicinity of 95 Cr. This implies PIX is currently trading at a PE of 11.5 based on FY23 estimated earnings. Viewed from this lens, the stock does look attractive.

Listed Peers

PIX’s major competitor in the Indian market is JK Fenner, which is not a publicly listed company. PIX and JK Fenner have a similar market share in India at 35-40% each.

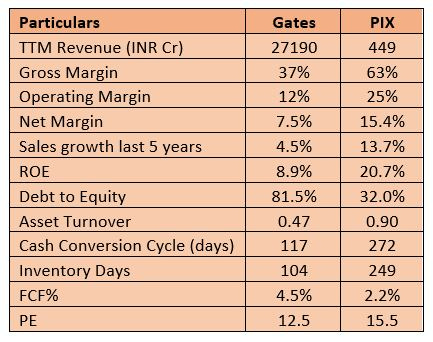

PIX’s largest global competitor is Gates Industrial Corporation plc (NYSE: GTES), an American company. Gates has a whopping 40% share of the NA (North America) market. It is worth studying Gates to understand the industry PIX operates in. So here we go:

Credits to Sahil from ValuePickr for extensively covering Gates.

Gates had revenues of $3.5B in 2021, with an EBITDA of $736M and a PAT of nearly $300M.

Power transmission accounted for 64% of revenue, with 63% of it coming from the replacement market, which is PIX’s primary market. Further, 46% of Gates’ sales came from the NA market. Thus their revenues from power transmission – replacement segment stood at roughly $650M. Gates commands a 40% share in the NA market. This puts the total NA market at $1.6B. I could not find out Gates’ share of the global market but if we assume it to be 40% akin to the NA market, we can conclude the global market size for PIX’s products to be $3.5B. So PIX has about 1.7% share in the global market. This crude calculation gives us an estimate of the opportunity size for PIX.

Gates is clearly a giant in this industry. How do PIX’s numbers look relative to Gates’? Let’s take a look…

PIX fares better in every aspect other than Cash Conversion and Free Cash Flow generation.

Gates is growing on the back of robust global demand. Management has guided for a 6-9% growth in revenue in their outlook for 2022. Inflation pressures may have dented earnings slightly but overall stable gross margins suggest an ability to pass on price hikes to customers. PIX enjoys superior margins and if we view Gates’ performance as an indicator of the strength in global demand for belts, PIX is well poised for growth.

Disclosure: I hold PIX in my portfolio. My views may be biased.

Disclaimer: This is not investment advice. I am not SEBI registered. Everything shared here is my personal view, and is shared for the purpose of increasing your vast knowledge. I may be completely wrong in my analysis. Please do your own research and consult your financial advisor before making investment decisions.

Amusing Finding

The first documented use of belt drives dates back to 15 BC in China. The first ever mechanized spinning wheel documented a thousand years later, also used a belt drive. It is intriguing to note that to this day the textile industry relies heavily on belt drives.

In 1908, Henry Ford launched the historic Model T - widely regarded as the first affordable automobile. This was a turning point in the automobile industry as the middle class could now afford car travel. Soon William Durant set up General Motors and the demand for automobiles went through the roof. In 1917, the vulcanized rubber V-belt was invented. 100 years later, timing belt drives continue to power most cars we see today.

I digress, but I was wondering why Henry Ford called it the Model T. Apparently he named his first design the Model A and carried the alphabet forward with each new design. I guess not everything has to be complex. I’ll leave you with a picture of the magnificent Model T...

Stay invested!

Advait